The port and Sea

History

The Port of Trieste is linked to the international fame achieved in the first decade of the 19th century as the most important port of the Austro-Hungarian Empire, when the volumes of cargo handled ranked it as the 7th port in the world and the 2nd port in the Mediterranean after Marseille.

Historically, first under the Austro-Hungarian Empire until 1918, and then under the Kingdom of Italy, the Port of Trieste has always enjoyed special privileges in organisational and legal terms, which have enhanced its status as a place of international trade in a strategic geographical area.

After the Second World War, the Free Port of Trieste was “internationalised” by the Peace Treaty between Italy and the victorious powers, signed in Paris on 10 February 1947.

In response to the flourishing of trade with the Middle and Far East, following the opening of the Suez Canal in 1869, it was soon necessary to enlarge the port facilities even more. Initiated in the early 1900s, this project was mostly completed only in the 1920s and 1930s after Trieste was returned to Italy, thus giving birth to the New Port.

A quantum leap in the volume of traffic was made at the end of the 1960s, with the opening of the Transalpine Pipeline, and in the early 1970s, with the completion of the container terminal.

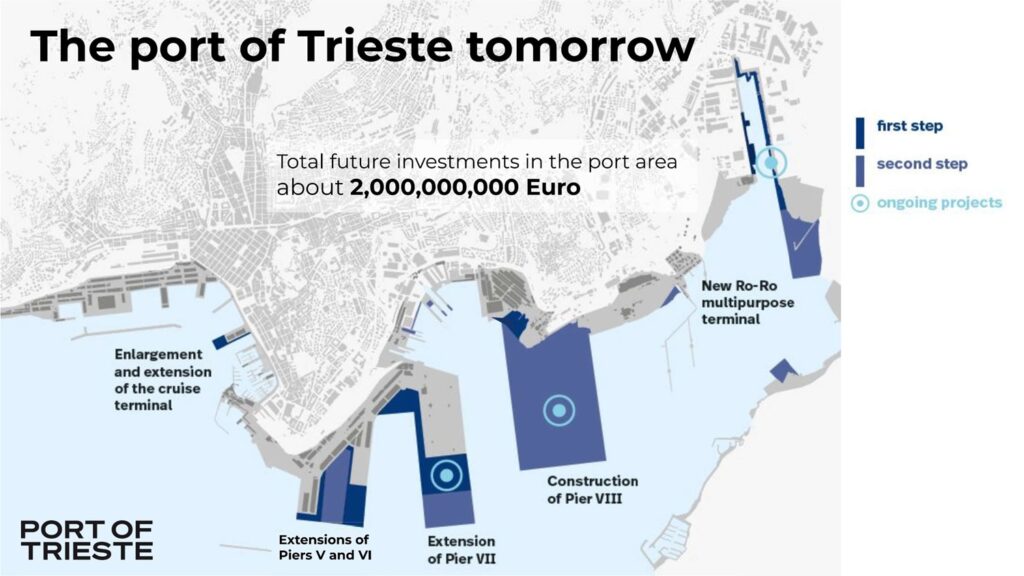

The Port later added new infrastructure to serve the needs of modern logistics, such as the multi-purpose terminal in the Old Port and the terminal for Ro-Ro vessels and ferries.

The start of the new century has seen strong, steady growth in intermodal rail services and in passenger traffic and marine tourism (pleasure craft and cruises). This complex profile, comprising a mixture of historical factors, technical know-how and material resources, is the strong point on which the Port of Trieste can now rely to fully recover its traditional role and importance in the European Economic Area and the Mediterranean.

Entrepreneurial history and spirit: Suez, Revoltella, Ghega

Despite its troubled history and the fluctuating attention of American, Italian, European, and global powers, the entrepreneurial spirit of Triestinos has remained steadfast. This enduring vitality, this spirit, drives the regional president to actively promote investment in the city and region, from the United States to Japan. It also inspires the city’s intrepid business families to collaborate on initiatives like the Trieste-Mumbai-Dubai partnership, propelling the New Golden Road forward.

A century and a half ago, Pasquale Revoltella, a Triestino entrepreneur, joined Ferdinand de Lesseps in the grand project to construct the Suez Canal. In doing so, he wasn’t just a financier—he was a visionary. Revoltella understood that the canal would revolutionize global trade, transforming Trieste into a linchpin between Europe and the vast markets of Asia and Africa. As vice president of the Suez Canal Company and a benefactor to the project, his legacy is a living reminder of Trieste’s entrepreneurial spirit and historic significance in Indo-Mediterranean trade.

Also a century and a half ago, Carlo Ghega, a Venetian engineer, revolutionized railway construction with the Semmering Railway, the first mountain railway in Europe. Overcoming extreme gradients, harsh terrain, and strong Bora winds, he designed viaducts, tunnels, and wind barriers that set new engineering standards. Completing the Vienna-Trieste Südbahn in 1857, a feat of engineering that became a UNESCO World Heritage Site in 1998, he secured Trieste’s role as a vital trade hub, seamlessly linking Central Europe to the Mediterranean.

Ghega’s pioneering work laid the foundation for modern alpine railways and intermodal transport, embodying the enduring entrepreneurial spirit of Trieste—one that continues to drive its resurgence as a global trade hub today.

Today, history is offering Trieste a chance to reprise its role as Italy most strategic country in the growth of the Indo-Mediterranean. And it is Ghega and Revoltella’s spiritual heirs – the business and political leaders of Trieste – who carry on his legacy, working to reinvigorate the New Golden Road and establish Trieste as a keystone in connecting Central-Eastern Europe to the Indo-Mediterranean.

Free Port

The Free Port of Trieste is unique in the Italian and EU legal system, above all because of the historical and political events surrounding its establishment and, more generally, those involving the territory of Trieste.

The Free Port of Trieste is political territory of the Italian State. Italian and European Union laws cannot, however, restrict the freedoms relating to customs duties and operations guaranteed by the Peace Treaty and its instruments of implementation. The legal status of the Free Port of Trieste is essentially embodied in two regimes: unrestricted access and transit and customs clearance exemption.

With regard to unrestricted access to the port, Annex VIII establishes free movement of goods and services and freedom of access and of transit without any discrimination and without customs duties or charges other than those levied for services rendered (see articles 1, 5, 10, 16 of Annex VIII; articles 2, 3, 6 and 7 of Commissarial Decree 29/1955; articles 6 and 7 of Commissarial Decree 53/1959). The rules intended to promote international trade, by removing every barrier or obstacle to the free provision of services and movement of goods and means of transit, are of great significance since this international regime is a forerunner of the single market within the European Union.

As regards the customs regime, the Free Zones of the Port of Trieste enjoy the legal status of customs clearance exemption, which involves a whole series of beneficial operating conditions for the Free Port of Trieste. This is undoubtedly the biggest area of difference between the regulations of the Free Port of Trieste and national and EU ones.

ADVANTAGES OF THE FREE PORT OF TRIESTE

• non-discriminatory right of entry of ships and cargo, irrespective of their destination, origin and nature, with the possibility of staying there for an indefinite period, free of duty, taxes or other charges other than those levied for services rendered, with no need for authorisation for loading, unloading, transhipment, movement and storage, and with no obligation to identify a customs destination for such cargo, which can be decided by the operator at a later date

• prohibition on customs intervention (and thus customs control of goods entering and leaving the Free Zones, which takes place only at the free-zone crossing points) when loading and unloading goods, except for specific exceptions under economic, health and public safety regulations (some goods, such as those under monopolies, weapons, drugs, pocketable items, must be placed in special warehouses supervised by Customs). Community goods are treated as leaving customs territory when they cross into the Free Zones, with the entry of EU goods into the Trieste Free Zones representing an export transaction not subject to VAT

• no time limit on the storage of goods

• no customs formalities to be completed as long as the goods stay in the Free Zones

• no customs duties to pay or to guarantee as long as the goods are in the Free Zones

• lower harbour dues than other Italian ports

• simplified transit for commercial vehicles directed abroad that are in transit to/from the Port of Trieste

• simplified customs system for the transit of goods by rail

• manipulation of goods permitted (eg. packaging, repackaging, labelling, sampling, eliminating brands, etc.) as well as their industrial transformation, completely free from any customs bond

• application of the customs deferred payment scheme, whereby duties and taxes on goods imported into the EU market through the Free Zones can be paid up to six months after the date of customs clearance at a particularly low annual interest rate (50% of 6M Euribor)

• mixtures of every kind may be made within the bonded area between products subject to excise duty

• customs status of goods (foreign country, EU free circulation without payment of VAT, import, export, transit) can be changed without the need to physically move the goods

• operators can access other alternative treatments permitted by EU and/or national legislation (eg. tax deposits, VAT deposits), if more favourable, with consequent compliance with the requirements of such rules

• possibility of extending the Free Zones

• application of practices used in other free ports around the world